Home > Blogs > Building customer relationships in the era of digital dialogues

Building customer relationships in the era of digital dialogues

“The world needs banking but it does not need banks” – Bill Gates

When Bills Gates made this statement in the 1990s, he was far sighted about how technology will impact banking.

I believe what the business guru possibly meant is that while banking-as-a-service will continue to be a necessity, the brick-and-mortar model will gradually reduce.

I understood this statement better when I recently visited my bank’s website.

I was wonderstruck with what I read …… “Ways to Bank”!!!

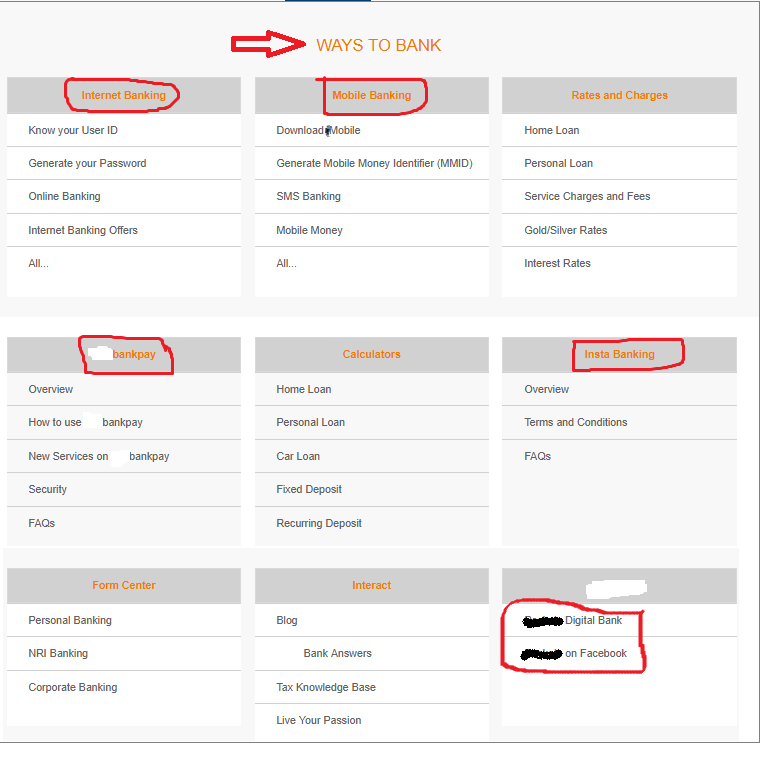

I explored and here is an image of what I saw.

While the “Ways to bank” page of my bank’s website offered multiple options to perform banking, what surprised me was that there was no mention of “Branch banking” or “Bank in person” as a way to bank.

I mused on the missing part of the “Branch”.

The statement of Bill Gates echoed in my mind.

And then I realized it has been more than a year since I had any dialogue with my bank.

I paused and thought over why I had stopped calling or visiting my bank.

Did I stop performing banking transactions altogether? No!

I continued to avail banking services but through digital channels; with a silent digital dialogue.

I pondered and compared my digital interactions with the lively human conversations I used to enjoy during my bank visits.

Given below are few thoughts from my experience of banking digitally.

My account number is my new identity

In the years of branch banking, in the interest of saving time, getting proper service and completing my transactions smoothly I’d ensure that I was there when the bank branch opened. My banker greeted me and knew my personal and professional background.

In contradiction, my bank in digital avatar is 24 /7 accessible.

And my digital bank greets me, with a digital identity vide an account number!

My digital bank is now my one-stop financial shop

My bank used to have simple personal banking products that met my banking needs of having a savings account, a term deposit, and may be a loan.

My digital bank is now a one-stop financial shop. It offers me every financial product I could wish to have. I could avail it as a package too! For example, I could apply for a savings account with a debit or credit card or say linked insurance or a demat account.

All information on the products is readily available digitally, but what I could still miss out could be the hidden fees or penalty. My bank branch will have harped on this key information a few times before I make a decision to apply.

I need to “bank safe”

I chose my brick-and-mortar bank branch on the merits of its transparency in dealing with public monies. As a regulated entity, I trusted my bank as a care-taker of my money with a guarantee of getting it back in case of a future meltdown. I read to understand how banks are responsible for safe-guard its customers’ monies.

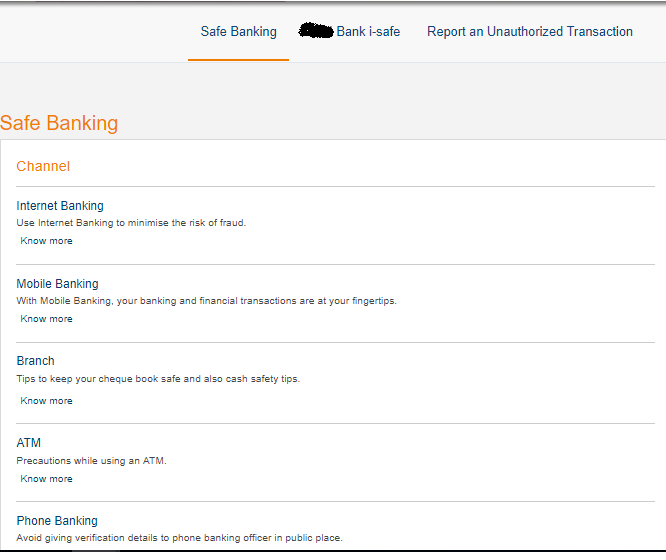

The new digital avatar however empowers me to educate myself on what safe banking is. Below is an image of how my digital bank advocates safe banking.

But I necessarily need to do my bit of learning to ensure my money is safe.

Wasn’t it simpler in brick-and-mortar branch banking?

A silent digital conversation defines my customer journey

A fortnightly visit to my bank branch ensured that my banking transactions were complete. I would withdraw cash, deposit cheques, operate my locker and have my usual human conversation with my bankers. And that was my customer journey!!!

In the digital avatar, a customer journey relates to a seamless cross channel experience that is frictionless.

I am not tied to a single channel; I can start with internet banking later switch to mobile for completing a transaction. All my banking transactions can be performed digitally without need for visiting a branch. Through silent digital conversation!!!

In the process my banking was completed but not my innate need for getting attended as a customer.

Can banks add “human” to “digital”?

I compared every single experience in my bank premise vs. the digital avatar of my bank.

I rarely visited my Bank. But how I wished I still got the same treatment as I used to get in a bank branch.

The missing aspect of the silent digital conversation was the “human” interaction.

No qualms that digital is going to drive the future of banking.

Hence building customer relationship is imperative in the era of digital dialogues.

Few steps towards this could be

To conclude, banks need to make deliberate effort to maintain the personal contact with their digital banking customers. Ultimately, it is the human connection that fuels long term customer relationships and loyalty.

Else digital banking customers will remain stateless numbers stored in banking software systems.

Srividya P N

More blogs from Srividya P N >